painofhell

Posts : 669 Posts : 669

Birthday : 1990-05-18

Join date : 2014-08-16

Age : 34

Job/hobbies : forex

|  Subject: japanese candlesticks Subject: japanese candlesticks  Wed Aug 20, 2014 3:12 pm Wed Aug 20, 2014 3:12 pm | |

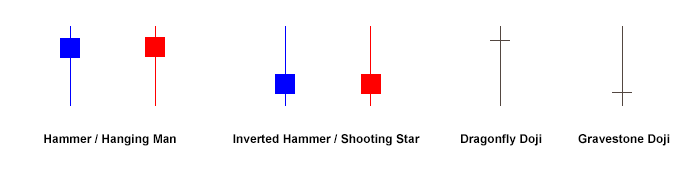

| Basic Candlesticks PatternsOriginating in Japan, candlestick charting is by far the most commonly traded type of chart in Forex. They were originally used to trade the stock market and if you search around the web you will find that the subject can be made very complex. There are so many different candlestick patterns and sometimes a single pattern may have several names, it can get quite confusing. Fortunately not all of the candlestick patterns out there apply to Forex and a simplified way of looking at candlesticks can be applied.The structure of how the candlestick is created was covered in the previous lesson, let’s pick up from there and take a look at the basic ways a candlestick can present itself. I will use the official names of each pattern for now and later on you will understand that it all breaks down to a message of indecision, or decisiveness, and it matters more the ‘where’ and the ‘after what’ that these patterns are occurring. This will make complete sense to you later if it doesn’t already. MarubozoThe first way that a candlestick can present itself is with no shadow (wick) and has been named the ‘Marubozu’. This type of candle simply means that the market has moved in one direction without any real challenge for the duration of the time frame you are watching. A bullish marubozu will have its close as its high and its open as its low, this signifies clearly that the bulls (buyers) have good control. A bearish marubozu will have its close as its low and its open as its high, this signifies clearly that the bears (sellers) have good control. It is actually very rare to see a perfect marubozu with no shadow in Forex so expect to see a little wick on each side of it. This pattern indicates decisiveness in the market.Spining TopThe other way a candlestick can present itself is with a small body and large shadows. There are quite a few patterns with the same traits which we will cover shortly but for now we will start with the most neutral, the spinning top. This pattern indicates a strong battle took place between the bears and the bulls yet neither made much ground. The market pushed up to the high and was rejected, the market pushed down to the low and was rejected. Sometimes the buyers will have made a little progress, sometimes the sellers will have made a little progress, but overall the sign is indecision.DojiThe final of the most basic ways a candlestick can present itself is the doji. This pattern is very much like the spinning top in its messages only in this case neither the bulls or the bears made any progress. There was still a battle as the new high, and the new low, were reached and rejected, but the open and close price are the same. This is an extreme case of indecision because clearly neither the buyers or the seller were able to gain control.Single Candlesticks PatternsNow that you have understood the basic forms a candlestick can take we will take a look at some of the variations that can occur. When it comes to the marubozu just expect a little wick on either side and there is no real variation, the candlestick style of the spinning top and doji on the other hand are worth further study. MarubozoThe first way that a candlestick can present itself is with no shadow (wick) and has been named the ‘Marubozu’. This type of candle simply means that the market has moved in one direction without any real challenge for the duration of the time frame you are watching. A bullish marubozu will have its close as its high and its open as its low, this signifies clearly that the bulls (buyers) have good control. A bearish marubozu will have its close as its low and its open as its high, this signifies clearly that the bears (sellers) have good control. It is actually very rare to see a perfect marubozu with no shadow in Forex so expect to see a little wick on each side of it. This pattern indicates decisiveness in the market.Spining TopThe other way a candlestick can present itself is with a small body and large shadows. There are quite a few patterns with the same traits which we will cover shortly but for now we will start with the most neutral, the spinning top. This pattern indicates a strong battle took place between the bears and the bulls yet neither made much ground. The market pushed up to the high and was rejected, the market pushed down to the low and was rejected. Sometimes the buyers will have made a little progress, sometimes the sellers will have made a little progress, but overall the sign is indecision.DojiThe final of the most basic ways a candlestick can present itself is the doji. This pattern is very much like the spinning top in its messages only in this case neither the bulls or the bears made any progress. There was still a battle as the new high, and the new low, were reached and rejected, but the open and close price are the same. This is an extreme case of indecision because clearly neither the buyers or the seller were able to gain control.Single Candlesticks PatternsNow that you have understood the basic forms a candlestick can take we will take a look at some of the variations that can occur. When it comes to the marubozu just expect a little wick on either side and there is no real variation, the candlestick style of the spinning top and doji on the other hand are worth further study. Hammer / Hanging ManThe hammer and the hanging man are just different naming conventions for the same pattern. If this pattern occurs after a downtrend then it is called a hammer, if this pattern occurs after an uptrend then it is called a hanging man. Both the hammer and the hanging man can be either color of candle and it all boils down to a message indecision once again. What matters is the ‘where’ and the ‘after what’ that this indecision is occurring.Inverted Hammer / Shooting StarThis next pattern is just a mirror flip of the previous and the message is just the same, indecision. If this pattern occurs after a downtrend then it is called an inverted hammer, if this pattern occurs after an uptrend then it is called a shooting star. Both the inverted hammer and the shooting star can be either color of candle and what matters is the ‘where’ and the ‘after what’ that this indecision is occurring. You probably noticed that this ‘where’ and ‘after what’ is a theme so we won’t mention it again until the end of this lesson.Dragonfly Doji & Gravestone DojiThese two patterns present themselves as differently as a hanging man and a shooting star but both maintain the same message of indecision. It’s important to note though that indecision does not mean reversal and must be used in confluence with everything you will learn here at ElectroFX (This material has to be presented in some sort of order so you haven’t understood what ‘everything else’ is yet, patience grasshopper).Double Candlesticks PatternsThere are also some candlestick patterns that require more than a single candle to relay their message. Sometimes these double candlestick patterns will also contain a single candlestick pattern within them. Try not to think about it too much just yet as everything will become clearer later on, for now, focus on learning to recognize the patterns. Hammer / Hanging ManThe hammer and the hanging man are just different naming conventions for the same pattern. If this pattern occurs after a downtrend then it is called a hammer, if this pattern occurs after an uptrend then it is called a hanging man. Both the hammer and the hanging man can be either color of candle and it all boils down to a message indecision once again. What matters is the ‘where’ and the ‘after what’ that this indecision is occurring.Inverted Hammer / Shooting StarThis next pattern is just a mirror flip of the previous and the message is just the same, indecision. If this pattern occurs after a downtrend then it is called an inverted hammer, if this pattern occurs after an uptrend then it is called a shooting star. Both the inverted hammer and the shooting star can be either color of candle and what matters is the ‘where’ and the ‘after what’ that this indecision is occurring. You probably noticed that this ‘where’ and ‘after what’ is a theme so we won’t mention it again until the end of this lesson.Dragonfly Doji & Gravestone DojiThese two patterns present themselves as differently as a hanging man and a shooting star but both maintain the same message of indecision. It’s important to note though that indecision does not mean reversal and must be used in confluence with everything you will learn here at ElectroFX (This material has to be presented in some sort of order so you haven’t understood what ‘everything else’ is yet, patience grasshopper).Double Candlesticks PatternsThere are also some candlestick patterns that require more than a single candle to relay their message. Sometimes these double candlestick patterns will also contain a single candlestick pattern within them. Try not to think about it too much just yet as everything will become clearer later on, for now, focus on learning to recognize the patterns. Bullish Engulfing / Bearish EngulfingIn short; these patterns display an overpowering of one force by the other. For the bullish engulfing pattern that means the buyers have overpowered the sellers and the opposite applies to the bearish engulfing pattern. Here at ElectroFX both of these patterns were given the nickname of ‘CEC’ (Candle eats Candle) to simplify the reference. They display a level of decisiveness on direction that can be very powerful if happening at the right place.Tweezer Bottoms / Tweezer TopsThe first thing that you will notice with these patterns is that they contain single candlestick patterns within them. The great thing about the tweezer tops and bottoms though is that they also display a double rejection from the exact same price point. So not only do you get a pair of single indecision candlestick patterns side by side, you also get the message of a double tap. Although the tweezer tops and bottoms don’t show as much directional decisiveness as the engulfing patterns they are not far behind.The Inside BarThe last of the double candlestick patterns is the inside bar. Their main characteristic is the latest of the two candles being contained within the previous, this could even be extended to a third or fourth bar if they continued to be contained. They give you a message of indecision or consolidation and are not to be confused with the engulfing patterns.Do All These Names Really Matter?In all reality the names that have been given to these different candlestick patterns are useful for traders talking to traders. However, any candlestick that has a small body with long wicks can just as easily be referred to as a pinbar. That means you could take all of these – spinning top, doji, hammer, hanging man, inverted hammer, shooting star, dragonfly doji, gravestone doji – and call them all pinbars, much easier right? Furthermore every single candlestick pattern on this page, except for the marubozu, can just be called an indecision candle. Don’t worry, by the time you finish all the material here at ElectroFX you will know what the right place is. Bullish Engulfing / Bearish EngulfingIn short; these patterns display an overpowering of one force by the other. For the bullish engulfing pattern that means the buyers have overpowered the sellers and the opposite applies to the bearish engulfing pattern. Here at ElectroFX both of these patterns were given the nickname of ‘CEC’ (Candle eats Candle) to simplify the reference. They display a level of decisiveness on direction that can be very powerful if happening at the right place.Tweezer Bottoms / Tweezer TopsThe first thing that you will notice with these patterns is that they contain single candlestick patterns within them. The great thing about the tweezer tops and bottoms though is that they also display a double rejection from the exact same price point. So not only do you get a pair of single indecision candlestick patterns side by side, you also get the message of a double tap. Although the tweezer tops and bottoms don’t show as much directional decisiveness as the engulfing patterns they are not far behind.The Inside BarThe last of the double candlestick patterns is the inside bar. Their main characteristic is the latest of the two candles being contained within the previous, this could even be extended to a third or fourth bar if they continued to be contained. They give you a message of indecision or consolidation and are not to be confused with the engulfing patterns.Do All These Names Really Matter?In all reality the names that have been given to these different candlestick patterns are useful for traders talking to traders. However, any candlestick that has a small body with long wicks can just as easily be referred to as a pinbar. That means you could take all of these – spinning top, doji, hammer, hanging man, inverted hammer, shooting star, dragonfly doji, gravestone doji – and call them all pinbars, much easier right? Furthermore every single candlestick pattern on this page, except for the marubozu, can just be called an indecision candle. Don’t worry, by the time you finish all the material here at ElectroFX you will know what the right place is.  |

|